Eastspring Investments

Designing a Provident Fund Management Ecosystem for Multiple Stakeholders

Year

2023

Role

UX/UI Design

Client

Eastspring Investments A Prudential plc company

/ Background

Eastspring Investments is a global asset manager delivering investment solutions across Asia through the collaboration of TMBAM Eastspring, Thanachart Fund Eastspring, and Eastspring Investments (Singapore).

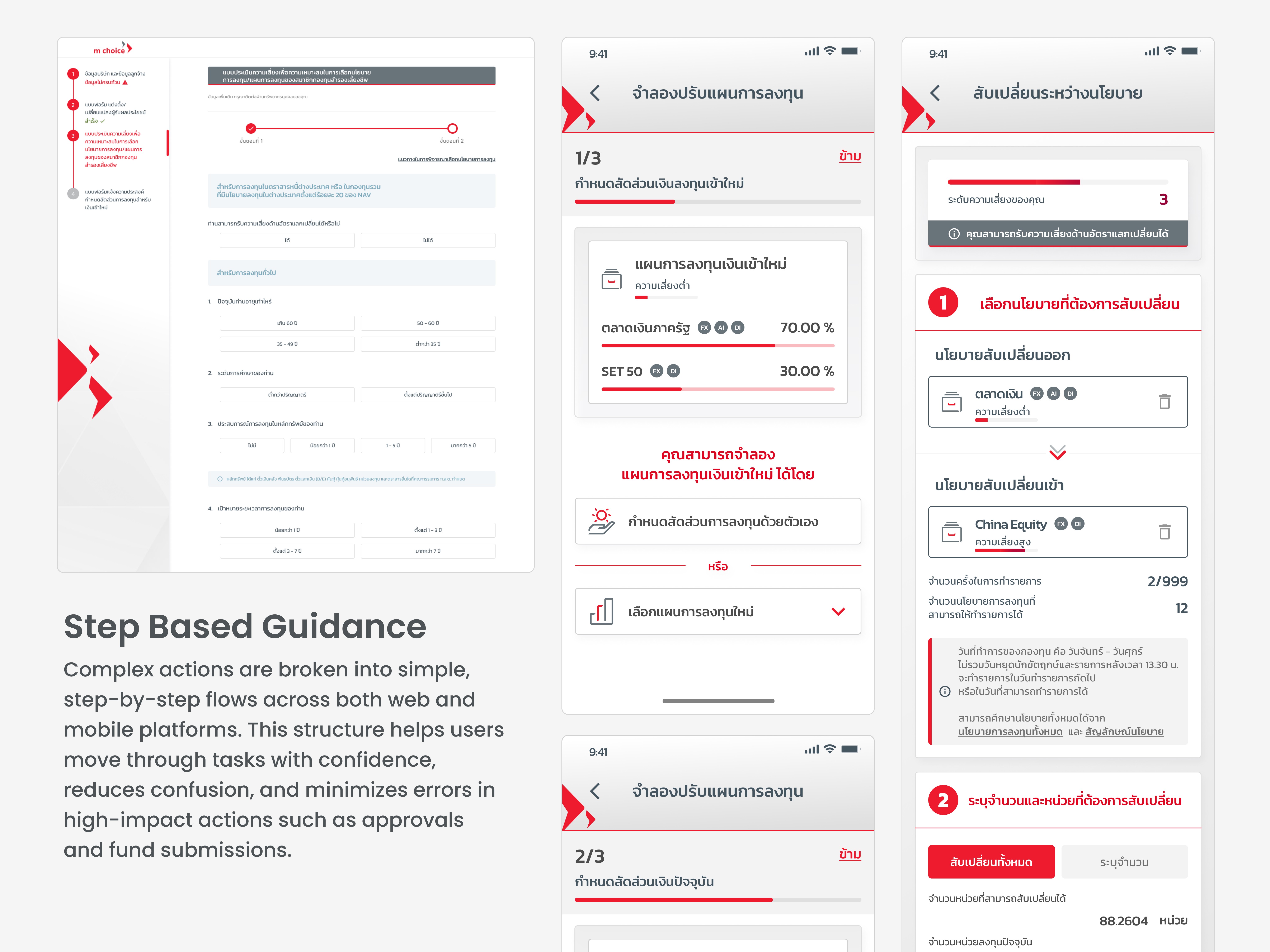

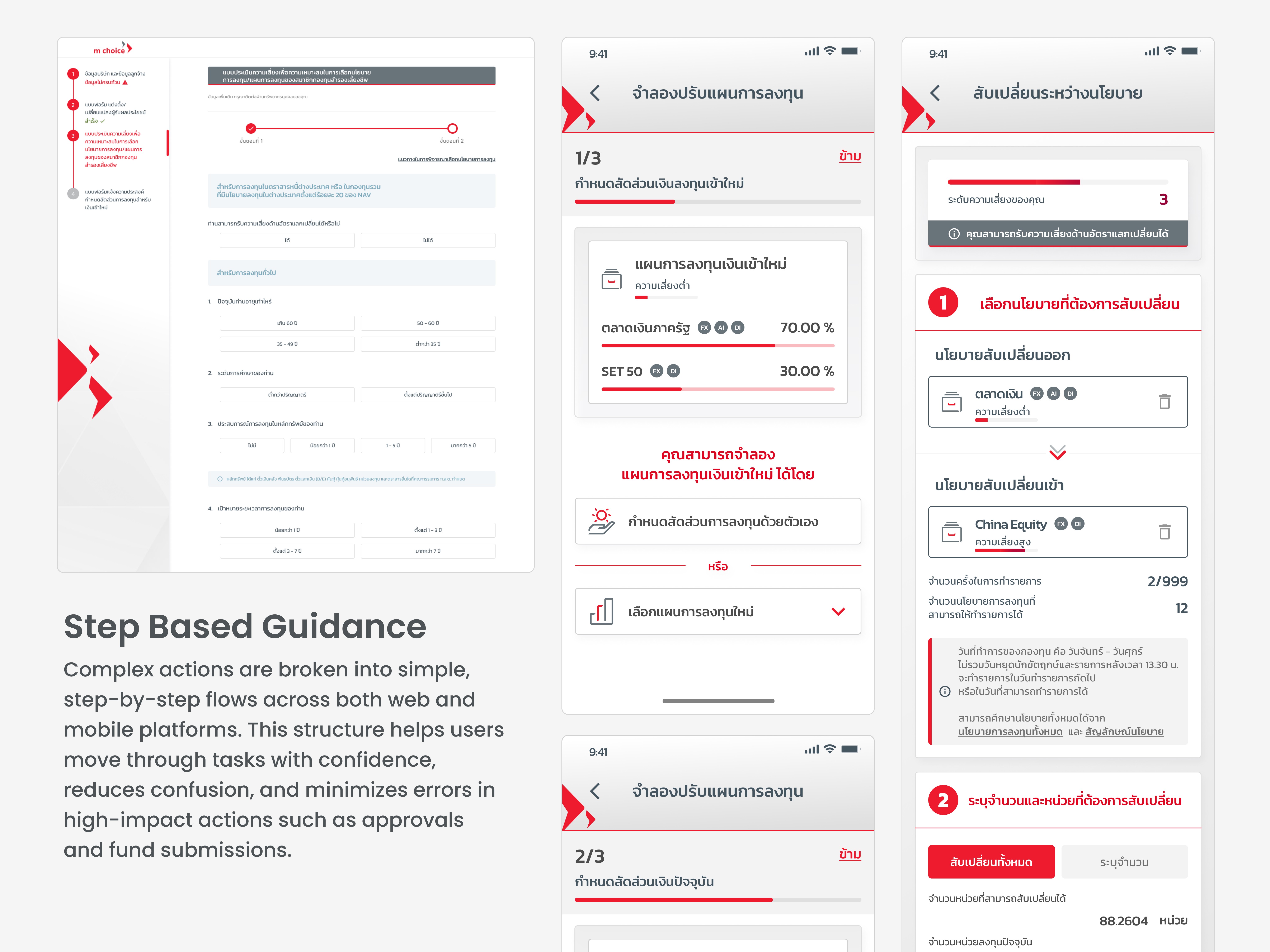

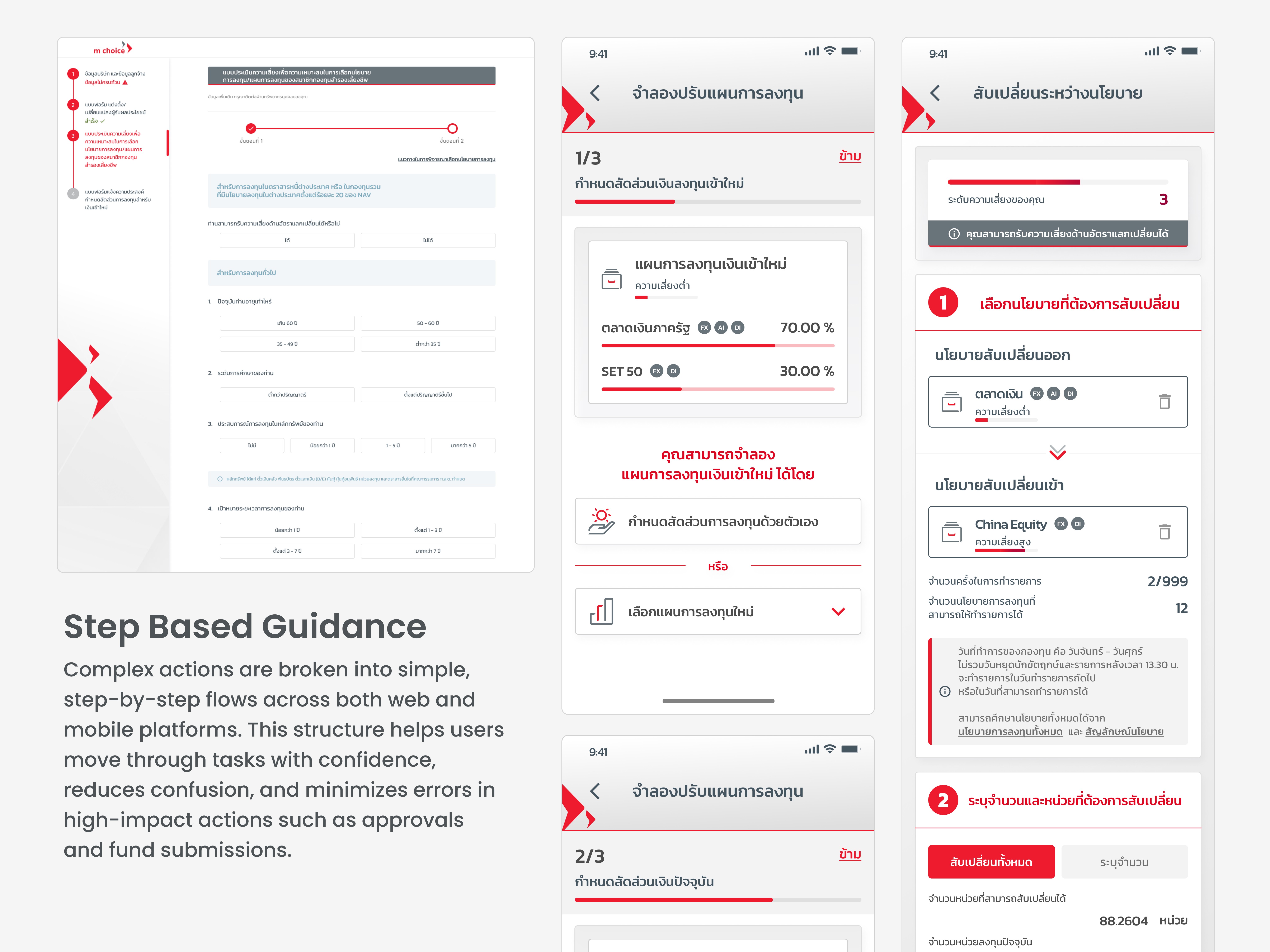

This project focused on the first development phase of a Provident Fund (PVD) management ecosystem that supports long-term fund operations across multiple stakeholders, including employees, employers, fund committees and Eastspring agents.

/ Design Process

The challenge was that this was not a single product but a distributed ecosystem in which the same provident fund data flowed across multiple platforms. Different roles interacted with the same transactions in different ways, and changes in one platform such as approval logic or menu structure could affect others.

The key challenges were defining clear role boundaries without duplicating functionality, managing high dependency between platforms, and maintaining consistency while supporting very different use cases. The main risk was fragmentation. Designing each platform independently would increase operational errors, maintenance costs, and regulatory risk, which made a systemic approach essential to addressing the challenge.

Eastspring Investments

Designing a Provident Fund Management Ecosystem for Multiple Stakeholders

Year

2023

Role

UX/UI Design

Client

Eastspring Investments A Prudential plc company

/ Background

Eastspring Investments is a global asset manager delivering investment solutions across Asia through the collaboration of TMBAM Eastspring, Thanachart Fund Eastspring, and Eastspring Investments (Singapore).

This project focused on the first development phase of a Provident Fund (PVD) management ecosystem that supports long-term fund operations across multiple stakeholders, including employees, employers, fund committees and Eastspring agents.

/ Design Process

The challenge was that this was not a single product but a distributed ecosystem in which the same provident fund data flowed across multiple platforms. Different roles interacted with the same transactions in different ways, and changes in one platform such as approval logic or menu structure could affect others.

The key challenges were defining clear role boundaries without duplicating functionality, managing high dependency between platforms, and maintaining consistency while supporting very different use cases. The main risk was fragmentation. Designing each platform independently would increase operational errors, maintenance costs, and regulatory risk, which made a systemic approach essential to addressing the challenge.

Eastspring Investments

Designing a Provident Fund Management Ecosystem for Multiple Stakeholders

Year

2023

Role

UX/UI Design

Client

Eastspring Investments A Prudential plc company

/ Background

Eastspring Investments is a global asset manager delivering investment solutions across Asia through the collaboration of TMBAM Eastspring, Thanachart Fund Eastspring, and Eastspring Investments (Singapore).

This project focused on the first development phase of a Provident Fund (PVD) management ecosystem that supports long-term fund operations across multiple stakeholders, including employees, employers, fund committees and Eastspring agents.

/ Design Process

The challenge was that this was not a single product but a distributed ecosystem in which the same provident fund data flowed across multiple platforms. Different roles interacted with the same transactions in different ways, and changes in one platform such as approval logic or menu structure could affect others.

The key challenges were defining clear role boundaries without duplicating functionality, managing high dependency between platforms, and maintaining consistency while supporting very different use cases. The main risk was fragmentation. Designing each platform independently would increase operational errors, maintenance costs, and regulatory risk, which made a systemic approach essential to addressing the challenge.